The EB5 Regional Center Program presents a compelling opportunity for foreign investors seeking U.S. residency through targeted investments aimed at job creation and economic development.

With investment thresholds of $1 million or $500,000 in designated areas, the program's nuances require careful navigation. Selecting the right regional center is paramount, as it influences both the likelihood of meeting the necessary job creation criteria and the potential for financial returns.

Understanding these critical elements can significantly enhance the prospects of success, yet many investors overlook key factors that could impact their journey.

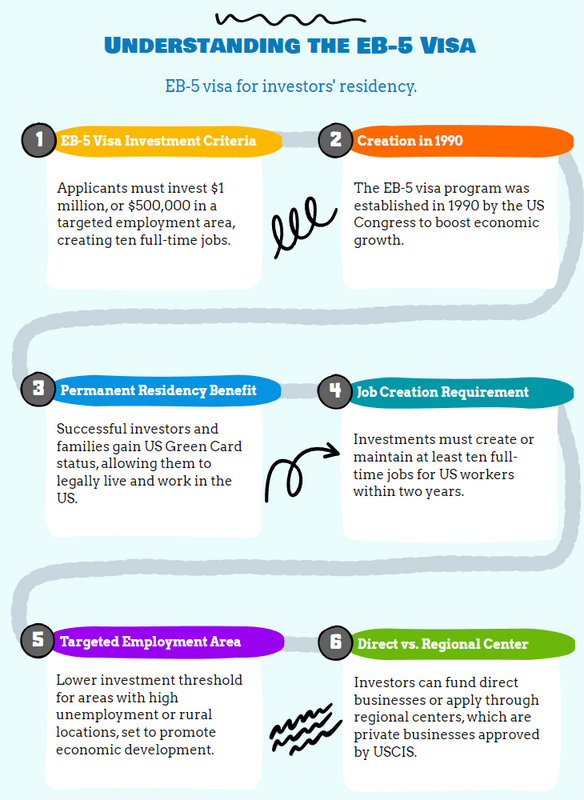

The EB5 Regional Center Program represents a significant opportunity for foreign investors seeking to obtain U.S. permanent residency through investment. Established by the U.S. Congress in 1990, the program is designed to stimulate the U.S. economy by attracting foreign capital and creating jobs.

Investors can qualify for a green card by investing a minimum of $1 million in a new commercial enterprise, or $500,000 in a targeted employment area.

Investments must lead to the creation of at least ten full-time jobs for U.S. workers. The program operates through designated Regional Centers, which facilitate investment in various projects, providing a streamlined process that reduces the complexity of direct investment. The EB5 program thus serves as a vital conduit for economic growth and immigration.

To participate in the EB5 Regional Center Program, investors must meet specific eligibility criteria established by U.S. Citizenship and Immigration Services (USCIS). Primarily, the investor must demonstrate the ability to invest a minimum amount, which is typically $1 million or $500,000 in targeted employment areas.

Additionally, the funds must be lawfully obtained, and investors must provide evidence of the source of their capital. Applicants must also show a commitment to creating or preserving at least ten full-time jobs for U.S. workers within two years of the investment.

Furthermore, the investor should be prepared to engage actively in the business, although direct management is not a requirement. Meeting these requirements is essential for a successful application to the EB5 program.

Investors exploring the EB5 Regional Center Program can choose from various investment options that cater to different financial capabilities and project types. The standard minimum investment amount is $1 million; however, in targeted employment areas (TEAs), this amount is reduced to $800,000.

This flexibility allows investors to align their financial commitments with specific regional economic needs. Projects may range from real estate developments to infrastructure initiatives, providing diverse opportunities for capital deployment.

Each investment must demonstrate the potential to create at least ten full-time jobs for U.S. workers, a critical requirement for obtaining permanent residency. Careful consideration of investment types and amounts is essential to maximize both financial returns and immigration benefits within the EB5 framework.

Selecting the right regional center is a pivotal step in the EB5 investment process, as it significantly influences both the potential for financial return and the likelihood of meeting immigration requirements. Investors should conduct thorough due diligence, analyzing each center's track record, and project viability.

Factors such as the center's geographic location, industry focus, and historical success rates can provide valuable insights. Additionally, understanding the center's compliance with U.S. Citizenship and Immigration Services regulations is crucial, as non-compliance may jeopardize both investment and immigration status.

Engaging with experienced advisors can help navigate these complexities, ensuring that investors make informed decisions that align with their financial goals and immigration aspirations. Careful regional center selection lays the foundation for a successful EB5 journey.

Although the EB5 application process may seem daunting, understanding its steps can facilitate a smoother experience for applicants. The journey begins with selecting an EB5 regional center that aligns with goals.

Next, applicants must complete Form I-526, the Immigrant Petition by Alien Investor, providing comprehensive documentation of the investment and source of funds. Upon approval, applicants can then file Form I-485 or consular processing for their immigrant visa.

After receiving conditional permanent residency, investors must meet job creation and investment requirements to file Form I-829, seeking removal of conditions. Timely submissions and thorough documentation at each stage are essential to ensure compliance and expedite the process, ultimately leading to successful U.S. residency through the EB5 program.

The EB5 investment program offers a unique opportunity for foreign nationals seeking U.S. permanent residency, presenting both substantial benefits and inherent risks. On the one hand, successful participants gain a pathway to a green card for themselves and their immediate family, along with the potential for financial returns from their investment.

Additionally, investing in a regional center can stimulate economic growth in targeted areas, creating jobs and fostering community development. Conversely, the risks include potential loss of capital, project delays, and the possibility that the investment may not meet the program's job creation requirements.

Furthermore, regulatory changes can impact the program's stability and attractiveness. Therefore, thorough due diligence is essential for prospective investors to navigate these challenges effectively.

If your investment project fails, it could significantly impact your EB-5 visa application. The U.S. Citizenship and Immigration Services (USCIS) requires proof that your investment has created or preserved the requisite number of jobs. A project failure may jeopardize this requirement, leading to potential denial of your visa or removal from the program. It is essential to conduct thorough due diligence and consider risk management strategies before committing to any investment.

If a regional center fails, investors may face significant financial losses and potential delays in their immigration process. Typically, the failure of a regional center can lead to the loss of invested capital, as the projects may not generate the expected job creation necessary for visa approval. Investors should conduct thorough due diligence before committing funds and consider diversifying investments across multiple centers to mitigate risks associated with regional center failures.

The EB-5 application process typically takes between 18 to 24 months, although timelines can vary based on numerous factors, including the complexity of the case and the workload of U.S. Citizenship and Immigration Services (USCIS). Applicants should anticipate several stages, including the preparation of required documentation, submission of the I-526 petition, and potential requests for evidence. Engaging with experienced professionals can help streamline the process and ensure compliance with all regulatory requirements.